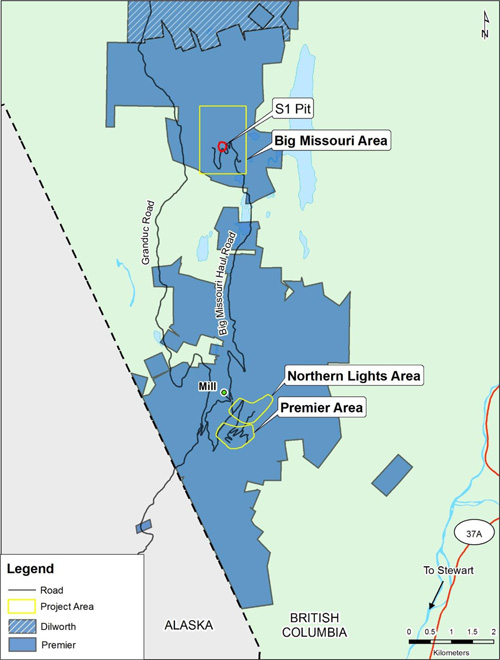

Vancouver, B.C. June 25, 2018 - Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce that drilling at a second target area, the Big Missouri ridge, located approximately 5km north of the Premier/Northern Lights area, has intercepted high-grade zones. The most notable intercepts are 7.3m of 15.34g/t AuEq* in hole P18-1652 and 7m of 10.34g/t AuEq in hole P18-1617. Ascot is currently undertaking a drill program north of the Premier/Northern Lights area as part of developing a second high-grade resource (see Figure 1).

Derek White, President and CEO of Ascot Resources commented, “Ascot is excited about the initial drill results from the Big Missouri area, especially to the southwest of the old S1 pit. These results clearly demonstrate the potential to outline high-grade zones in this area that can be valuable additions to the resource base at Premier/Northern Lights. The Company’s vision of re-starting the Premier mill with sufficient feed has just received a strong boost by these excellent results from Big Missouri.”

The Company is working towards recommencing underground production at the Premier site near Stewart, BC using existing facilities and infrastructure (mill building, tailings facility, underground development, power and road access). As a first step, the Company completed a maiden high-grade underground resource at Premier/Northern Lights and reported the results on May 10, 2018. The second step in the process is the 2018 drill program that commenced on April 16, 2018. The program is designed to extend mineralized zones at the Premier/Northern Lights area, convert current resources from inferred to indicated in existing zones (including the 602 zone), and to delineate high-grade zones in the Big Missouri/Martha Ellen area. The overall purpose is to increase the existing resource base in support of initial engineering studies that commenced in June 2018.

This news release summarizes the results from the first batch of 25 drill holes at Big Missouri. This area is connected to the Premier/Northern Lights area by an 8km haul road that leads to the Premier mill building (see Figure 1). The Big Missouri ridge hosts gold mineralization over a strike length of more than 6,000m. The mineralization is very similar to that in the Premier/Northern Lights area and has produced a significant number of high-grade intercepts that indicate the presence of material suitable for underground operations. The existing drill spacing at Big Missouri is fairly wide and will require higher resolution to outline high-grade zones.

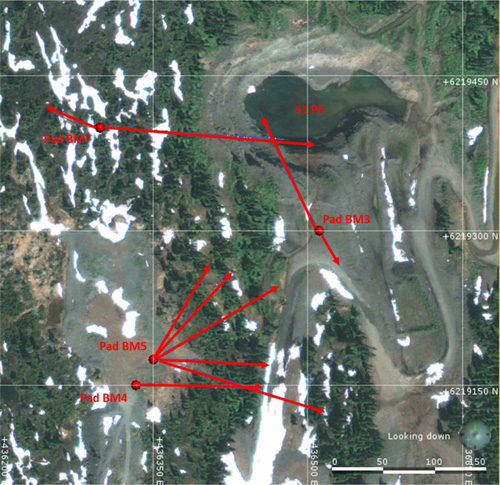

Figure 2 shows the location of the first four drill pads at Big Missouri. Drilling commenced in early May after the haul road was cleared of snow and initial pad locations became available. The drill program progresses from south to north as pads at higher elevation are cleared for operation. The purpose of the drill holes from the first four pads was to follow up a number of high-grade intercepts from previous drilling and to test the back of the high wall of the S1 pit that could be easily accessed from the floor of the pit. The S1 pit was mined by Westmin Resources in the early 1990s.

* For equivalency calculation refer to footnotes of Table 1.

Figure 1: Map of the southern part of Ascot’s Premier/Dilworth property showing the locations of the Premier/Northern Lights area that contains the high-grade underground resource, the Big Missouri area and the S1 pit.

Figure 2: Plan view of the S1 pit area at Big Missouri showing the pad location and drill traces of the drill holes reported in this release.

Drilling started at pad BM3 with four holes (P18-1612 through P18-1615) aimed to the northwest into the back wall of the S1 pit. The holes intercepted the gently west dipping mineralized zone and identified gold mineralization at relatively shallow depth, extending the mineralized zone from the open pit. Two holes (P18-1616, P18-1617) were drilled towards the southeast and intercepted high-grade mineralization to the south of the pit. Hole P18-1617 intercepted 7m of 10.34g/t AuEq. This high-grade zone is open to the south and southeast and will require additional drilling for better definition.

Pad 5 is the origin of nine drill holes (P18-1636 through P18-1638, P18-1642 through P18-1645, P18-1647, P18-1652) that were aimed towards several historical high-grade intercepts to the southwest of the S1 pit. With the exception of P18-1644, all drill holes intercepted significant mineralization. The best results from this pad came in hole P18-1645 which hit 5m of 15.01g/t AuEq from 101m and in hole P18-1652 intercepting 7.3m of 15.34g/t AuEq from 206.50m.

The seven drill holes (P18-1629 through P18-1635) from pad 7 form a fan that tested approximately 600m of dip extent to the west of the S1 pit. The drill holes consistently hit gold mineralization with grades improving towards the west.

Three holes (P18-1624 through P18-1626) were drilled to the east from pad 4, testing an area around a previous high-grade intercept. Two of the holes intercepted significant mineralization at two different elevations. The mineralized area close to surface is called the Province zone on top of the ridge and may be amenable to open pit extraction. The lower horizon is the Big Missouri zone and should be accessible through the S1 pit or through the existing underground structure.

Detailed drill results for all holes are listed in Table 1. The locations of drill pads are listed in Table 2.

Table 1: Summary of the drill results from the first batch of 25 holes at Big Missouri.

| Hole # | azimuth/dip | From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

AuEq (g/t) |

|

|---|---|---|---|---|---|---|---|---|

| P18-1612 | 330/-45 | 68.93 | 81.00 | 12.07 | 1.76 | 4.20 | 1.79 | |

| incl. | 78.00 | 81.00 | 3.00 | 3.82 | 4.70 | 3.85 | ||

| incl. | 78.00 | 79.00 | 1.00 | 6.50 | 8.90 | 6.56 | ||

| also | 157.58 | 162.72 | 5.14 | 1.32 | 7.90 | 1.37 | ||

| P18-1613 | 330/-55 | 56.10 | 58.00 | 1.90 | 1.82 | 8.00 | 1.87 | |

| P18-1614 | 330/-65 | 45.75 | 50.75 | 5.00 | 2.68 | 5.30 | 2.72 | |

| incl. | 45.75 | 46.75 | 1.00 | 9.75 | 3.10 | 9.77 | ||

| P18-1615 | 330/-75 | 40.00 | 45.00 | 5.00 | 1.72 | 12.90 | 1.81 | |

| also | 136.85 | 141.25 | 4.40 | 1.18 | 1.70 | 1.19 | ||

| P18-1616 | 150/-65 | 27.70 | 46.70 | 19.00 | 1.23 | 5.30 | 1.27 | |

| incl. | 33.70 | 39.70 | 6.00 | 3.12 | 9.60 | 3.19 | ||

| incl. | 34.70 | 36.70 | 2.00 | 7.98 | 24.40 | 8.15 | ||

| P18-1617 | 150/-85 | 29.20 | 52.25 | 23.05 | 3.23 | 4.30 | 3.26 | |

| incl. | 31.25 | 38.25 | 7.00 | 10.28 | 9.50 | 10.34 | ||

| incl. | 34.25 | 35.25 | 1.00 | 48.40 | 19.00 | 48.53 | ||

| P18-1624 | 90/-45 | 6.10 | 8.20 | 2.10 | 2.92 | 3.50 | 2.94 | |

| also | 53.10 | 54.50 | 1.40 | 2.63 | 7.30 | 2.68 | ||

| also | 111.00 | 113.00 | 2.00 | 2.56 | 5.90 | 2.60 | ||

| also | 119.00 | 121.00 | 2.00 | 2.50 | 6.90 | 2.55 | ||

| also | 157.50 | 164.20 | 6.70 | 1.25 | 4.90 | 1.28 | ||

| incl. | 161.00 | 162.00 | 1.00 | 4.16 | 5.00 | 4.19 | ||

| P18-1625 | 90/-58 | No significant intercept | ||||||

| P18-1626 | 90/-80 | 2.30 | 8.00 | 5.70 | 1.86 | 3.90 | 1.89 | |

| incl. | 4.90 | 5.90 | 1.00 | 5.65 | 10.20 | 5.72 | ||

| also | 78.00 | 80.00 | 2.00 | 4.03 | 4.00 | 4.06 | ||

| P18-1629 | 90/-45 | 207.90 | 226.65 | 18.75 | 2.06 | 5.30 | 2.10 | |

| incl. | 212.90 | 217.90 | 5.00 | 4.01 | 4.30 | 4.04 | ||

| incl. | 212.90 | 213.90 | 1.00 | 8.59 | 3.60 | 8.61 | ||

| P18-1630 | 90/-48 | 200.80 | 215.60 | 14.80 | 2.11 | 4.80 | 2.14 | |

| incl. | 200.80 | 204.80 | 4.00 | 3.52 | 4.80 | 3.55 | ||

| P18-1630 | 90/-48 | 200.80 | 215.60 | 14.80 | 2.11 | 4.80 | 2.14 | |

| incl. | 200.80 | 204.80 | 4.00 | 3.52 | 4.80 | 3.55 | ||

| incl. | 211.80 | 212.60 | 1.80 | 4.55 | 5.20 | 4.59 | ||

| P18-1631 | 90/-51 | 195.50 | 232.00 | 36.50 | 1.14 | 7.50 | 1.19 | |

| incl. | 211.00 | 222.70 | 11.70 | 2.39 | 8.50 | 2.45 | ||

| incl. | 213.00 | 215.30 | 2.30 | 6.65 | 8.30 | 6.71 | ||

| P18-1632 | 90/-55 | 191.00 | 210.45 | 19.45 | 1.19 | 3.80 | 1.22 | |

| incl. | 191.00 | 192.00 | 1.00 | 3.47 | 2.20 | 3.48 | ||

| incl. | 199.20 | 201.20 | 2.00 | 2.38 | 5.30 | 2.42 | ||

| incl. | 208.20 | 210.45 | 2.25 | 2.22 | 5.80 | 2.26 | ||

| P18-1633 | 90/-65 | 193.60 | 195.60 | 2.00 | 1.34 | 6.80 | 1.39 | |

| also | 245.55 | 248.00 | 2.45 | 1.26 | 10.50 | 1.33 | ||

| P18-1634 | 90/-80 | 178.55 | 187.55 | 9.00 | 3.44 | 27.70 | 3.63 | |

| incl. | 178.55 | 182.55 | 4.00 | 6.10 | 47.10 | 6.42 | ||

| incl. | 178.55 | 179.55 | 1.00 | 10.95 | 39.50 | 11.22 | ||

| P18-1635 | 270/-75 | 224.00 | 242.00 | 18.00 | 3.17 | 10.50 | 3.24 | |

| incl. | 224.00 | 226.00 | 2.00 | 11.10 | 6.40 | 11.14 | ||

| incl. | 240.00 | 242.00 | 2.00 | 8.41 | 21.00 | 8.55 | ||

| P18-1636 | 90/-50 | 19.30 | 21.00 | 1.70 | 2.56 | 6.70 | 2.61 | |

| also | 64.00 | 65.90 | 1.90 | 2.50 | 6.10 | 2.54 | ||

| also | 86.00 | 87.90 | 1.90 | 3.61 | 418.00 | 6.44 | ||

| P18-1637 | 90/-65 | no significant intercept | ||||||

| P18-1638 | 90/-75 | 1.52 | 9.00 | 7.48 | 1.90 | 4.40 | 1.93 | |

| incl. | 3.90 | 7.00 | 3.10 | 3.96 | 5.50 | 4.00 | ||

| also | 82.40 | 83.40 | 1.00 | 7.82 | 257.00 | 9.56 | ||

| P18-1642 | 90/-88 | 3.30 | 9.00 | 5.70 | 2.18 | 6.40 | 2.22 | |

| incl. | 5.30 | 7.00 | 1.70 | 4.23 | 12.40 | 4.31 | ||

| P18-1643 | 105/-50 | 141.40 | 143.50 | 2.10 | 12.45 | 8.80 | 12.51 | |

| P18-1644 | 105/-65 | no significant intercept | ||||||

| P18-1645 | 105/-80 | 86.00 | 92.00 | 6.00 | 1.44 | 172.20 | 2.61 | |

| also | 101.00 | 106.00 | 5.00 | 14.87 | 20.50 | 15.01 | ||

| incl. | 103.00 | 104.40 | 1.40 | 51.30 | 54.00 | 51.67 | ||

| P18-1647 | 45/-60 | 169.00 | 173.30 | 4.30 | 1.56 | 4.30 | 1.59 | |

| P18-1652 | 30/-68 | 156.00 | 174.50 | 18.50 | 9.48 | 4.00 | 9.51 | |

| incl. | 172.50 | 174.50 | 2.00 | 83.40 | 22.00 | 83.55 | ||

| also | 192.00 | 234.00 | 42.00 | 3.30 | 5.00 | 3.33 | ||

| incl. | 206.50 | 213.80 | 7.30 | 15.27 | 9.73 | 15.34 | ||

| incl. | 208.40 | 209.50 | 1.10 | 81.70 | 30.40 | 81.91 | ||

Gold equivalence was calculated using a ratio of 65:1 Ag:Au and Ag recovery of 45.2%.

True width is believed to be approximately 80-90% of reported intercepts.

Table2: Drill Pad Locations.

| Pad # | UTM N | UTM E | Elevation |

|---|---|---|---|

| BM3 | 6219300 | 436511 | 988 |

| BM4 | 6219150 | 436333 | 1062 |

| BM5 | 6219175 | 436350 | 1062 |

| BM7 | 6219400 | 436298 | 1080 |

The drill holes that are missing from the numbering sequence were drilled at Premier and will be reported separately.

The 2018 drill program is progressing well. There are currently five drill rigs in operation at Big Missouri and Martha Ellen. Snow removal is underway allowing all pad locations to be available in the near future.

Qualified Person

Graeme Evans, P. Geo, and Lawrence Tsang, P. Geo, the Company’s Project Geologists provide the field management for the Premier exploration program. Graeme Evans, who is a non-independent consulting geologist and the Company’s Qualified Person (QP) as defined by National Instrument 43-101, has reviewed and approved the technical contents of this news release.

Quality Assurance/Quality Control

Analytical work is being carried out by ALS Lab Group. Quality assurance and quality control programs include the use of analytical blanks and standards and duplicates in addition to the labs own internal quality assurance program. All samples were analyzed using multi-digestion with ICP finish and fire assay with AA finish for gold. Samples over 100 ppm silver were reanalyzed using four acid digestion with an ore grade AA finish. Samples over 1,500 ppm silver were fire assayed with a gravimetric finish. Samples with over 10 ppm gold were fire assayed with a gravimetric finish. Identified or suspected metallic gold or silver are subjected to “metallics” assays. For extreme high gold grades, a concentrate analysis is performed with a fire assay and gravimetric finish accurate up to 999985 ppm Au limit (ALS Au-CON01) method. Sampling and storage are at the company’s secure facility in Stewart with bi-weekly sample shipments made to ALS Labs Terrace prep site.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot Resources is a gold and silver focused exploration company with a portfolio of advanced and grassroots projects in the Golden Triangle region of British Columbia. The company’s flagship Premier Project is a near-term high-grade advanced exploration project with large upside potential. Ascot is poised to be the next Golden Triangle producer with an experienced and successful exploration, development and operating team, coupled with a highly regarded major shareholder.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release relative to markets about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “continue”, “estimate”, “predict”, “potential”, “targeting”, “intend”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding: the anticipated use of proceeds of the Offering, the Company’s 2018 drill program, and the exploration and mineralization potential of the Premier property, are forward-looking statements. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; and uncertainty as to timely availability of permits and other governmental approvals. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.