Vancouver, B.C. September 5, 2018 — Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce that drilling at the Big Missouri ridge has continued to intercept high-grade gold mineralization at all three known horizons: the Province zone close to surface; the Big Missouri zone at a depth of 160-200m; and an unnamed zone 100m below the Big Missouri zone. In addition, gold mineralization has been intercepted at the separate Unicorn zone. All areas are located at the Company’s Premier/Dilworth Property in northwestern BC. Highlights of this release include:

- 5.0m of 10.38g/t AuEq* in hole P18-1731 at the Big Missouri zone.

- 3.0m of 12.84g/t AuEq in hole P18-1713 at the Province zone.

- 5.0m of 18.31g/t AuEq in hole P18-1714 at the Province zone.

- 2.0m of 12.69g/t AuEq in hole P18-1726 at the Unicorn zone

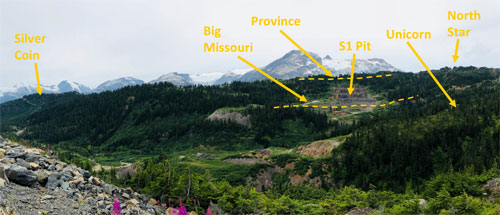

Figure 1 Image of the Big Missouri ridge, outlining the various areas of established gold mineralization described in this release with the exception of North Star.

* For equivalency calculation refer to footnotes of Tables 1 and 2.

Derek White, President and CEO of Ascot Resources commented, “The Big Missouri ridge continues to deliver high-grade gold intercepts with many of them easily accessible near surface or by side hill access. We are very excited about the high-grade resource potential of this entire area and we will continue to drill during September and October. Ascot is developing a high-grade underground resource for the Big Missouri ridge and the nearby Unicorn zone. In addition, the proximity of the Silver Coin property to the Big Missouri ridge strengthens our ability to provide additional resources for the re-start of the Premier mill facility.”

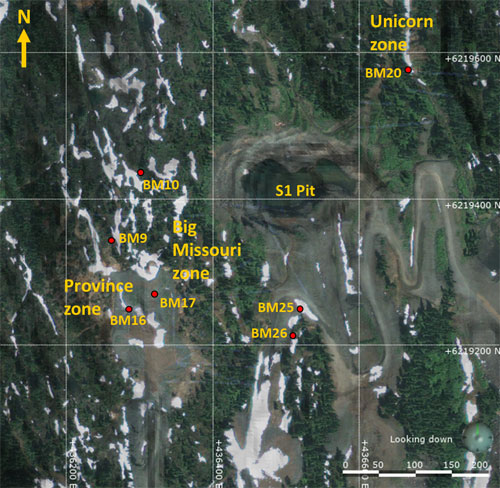

Figure 2. Plan view of the Big Missouri ridge showing the location of the drill pads discussed in this release. The drill holes for each pad are listed in table 4 below.

The Company is concurrently undertaking exploration activities to expand high-grade resources whilst working on engineering studies toward recommencing underground production near the Premier mill site. The Premier site has established facilities and infrastructure (mill building, tailings facility, power line and over 40 miles of underground development with ventilation and second egress). The current drill program is an integral part in this process which is to expand the existing resource base to support engineering studies that commenced in the second quarter of 2018.

This news release summarizes the results from 34 drill holes (P18-1709 to P18-1742) at the Big Missouri ridge and the Unicorn zone at Ascot’s Premier-Dilworth Property. The vision of the Ascot management team is to identify high-grade zones of mineralization that can be extracted economically. A higher drill density will be required to discover and define all high-grade zones in the area. Locations of drill pads are illustrated in Figure 2.

Province Zone

The Province zone is located at the top of the Big Missouri ridge to the west the of the S1 pit. Breccia hosted gold mineralization at the Province zone occurs close to surface at a higher elevation than the underlying Big Missouri zone. Five shallow drill holes (P18-1709-1713) targeted and intercepted the Province zone. All holes intercepted mineralization close to surface. Two additional holes (P18-1714 and P18-1728) were continued at depth to target the Big Missouri zone (results from these holes are reported in table 2). All Province intercepts add to the resource potential of this zone. Drill results from the five shallow holes at the Province zone are summarized in Table 1.

Table 1 Summary of the drill results from the Province zone at Big Missouri.

|

Hole # |

azimuth/dip |

From |

To |

Width |

Au |

Ag |

AuEq |

|

|

P18-1709 |

90/-60 |

|

3.85 |

8.00 |

4.15 |

2.10 |

7.2 |

2.15 |

|

P18-1710 |

270/-45 |

|

2.00 |

32.00 |

30.00 |

2.05 |

6.7 |

2.10 |

|

|

|

incl. |

3.00 |

8.00 |

5.00 |

3.80 |

5.4 |

3.84 |

|

|

|

incl. |

14.00 |

18.00 |

4.00 |

6.83 |

4.0 |

6.86 |

|

P18-1711 |

270/-85 |

|

2.00 |

27.20 |

25.20 |

1.16 |

4.0 |

1.19 |

|

|

|

incl. |

2.00 |

13.20 |

11.20 |

1.96 |

3.90 |

1.99 |

|

|

|

incl. |

11.20 |

13.20 |

2.00 |

6.07 |

2.00 |

6.08 |

|

P18-1712 |

180/-45 |

|

1.00 |

17.55 |

16.55 |

1.32 |

5.7 |

1.36 |

|

|

|

incl. |

11.55 |

14.55 |

3.00 |

3.44 |

3.7 |

3.47 |

|

|

|

incl. |

13.55 |

14.55 |

1.00 |

7.04 |

5.0 |

7.07 |

|

P18-1713 |

160/-45 |

|

1.80 |

24.00 |

22.20 |

2.43 |

9.3 |

2.49 |

|

|

|

incl. |

10.00 |

13.00 |

3.00 |

12.64 |

29.0 |

12.84 |

|

|

|

incl. |

10.00 |

11.00 |

1.00 |

31.54 |

79.0 |

32.08 |

Gold equivalence was calculated using a ratio of 65:1 Ag:Au and Ag recovery of 45.2%.

True width is believed to be approximately 80-90% of reported intercepts.

Big Missouri Zone

The Big Missouri zone is located to the west and southwest of the S1 pit and underlies the Province zone. This area was tested by 25 drill holes from 6 individual pads (BM 9, 10, 16, 17, 25 and 26).

A fan of six drill holes at BM 10 intercepted gold mineralization at the Big Missouri zone at a depth ranging from 160-200m in all but one hole (P18-1730). At BM 16, drill hole P18-1728 intercepted breccia and gold mineralization at all three levels known from the Big Missouri ridge. At BM 26, P18-1731 was drilled at a lower elevation and hit a high-grade area that occurred in a fault zone./p>

Several drill holes (P18-1721, 1722, 1729, 1731) intercepted mineralization at an intermediate elevation, indicating either an additional horizon of mineralization or some structural offset of one of the previously established ones.

The remaining holes at BM 9, 17, 25 and 26 intersected breccia horizons with anomalous gold mineralization below reportable grade.

Table 2 Summary of the drill results from the Big Missouri zone.

|

Hole # |

azimuth/dip |

From (m) |

To |

Width |

Au |

Ag |

AuEq |

|

|

P18-1714 |

160/-85 |

|

0.90 |

21.00 |

20.10 |

1.25 |

11.2 |

1.33 |

|

|

|

incl. |

15.00 |

18.00 |

3.00 |

2.21 |

46.0 |

2.52 |

|

|

|

also |

156.97 |

185.75 |

28.78 |

3.70 |

5.4 |

3.74 |

|

|

|

incl. |

168.75 |

173.75 |

5.00 |

18.22 |

13.6 |

18.31 |

|

|

|

incl. |

168.75 |

169.75 |

1.00 |

70.03 |

28.0 |

70.22 |

|

P18-1715 |

90/-55 |

|

189.50 |

199.00 |

9.50 |

1.53 |

3.9 |

1.56 |

|

|

|

incl. |

198.00 |

199.00 |

1.00 |

7.66 |

9.0 |

7.72 |

|

P18-1717 |

90/-75 |

|

181.00 |

195.60 |

14.60 |

1.10 |

8.8 |

1.16 |

|

P18-1718 |

90/-85 |

|

170.00 |

182.00 |

12.00 |

2.53 |

8.1 |

2.58 |

|

|

|

incl. |

181.00 |

182.00 |

1.00 |

9.13 |

9.0 |

9.19 |

|

|

|

|

192.00 |

200.00 |

8.00 |

1.78 |

3.9 |

1.81 |

|

P18-1721 |

330/-45 |

|

29.70 |

35.00 |

5.30 |

1.29 |

2.6 |

1.31 |

|

P18-1722 |

330/-70 |

|

18.00 |

30.00 |

12.00 |

1.65 |

3.7 |

1.68 |

|

|

|

incl. |

20.00 |

26.30 |

6.30 |

2.54 |

4.7 |

2.57 |

|

P18-1728 |

90/-82 |

|

1.52 |

12.00 |

10.48 |

1.07 |

4.5 |

1.10 |

|

|

|

|

160.00 |

178.00 |

18.00 |

1.79 |

17.3 |

1.91 |

|

|

|

incl. |

170.00 |

178.00 |

8.00 |

2.50 |

4.5 |

2.53 |

|

|

|

also |

257.00 |

270.70 |

13.70 |

3.47 |

2.9 |

3.49 |

|

|

|

incl. |

269.70 |

270.70 |

1.00 |

32.52 |

18.0 |

32.64 |

|

P18-1729 |

0/-45 |

|

50.10 |

56.80 |

6.70 |

1.87 |

16.9 |

1.98 |

|

P18-1731 |

330/-70 |

|

69.00 |

74.00 |

5.00 |

10.33 |

8.0 |

10.38 |

|

|

|

incl. |

71.50 |

74.00 |

2.50 |

19.69 |

13.0 |

19.78 |

|

P18-1735 |

90/-55 |

|

44.00 |

51.00 |

7.00 |

2.14 |

8.0 |

2.19 |

|

|

|

also |

215.20 |

218.25 |

3.05 |

4.91 |

12.5 |

4.99 |

|

|

|

incl. |

216.20 |

217.25 |

1.05 |

10.25 |

21.0 |

10.39 |

|

P18-1737 |

90/-75 |

|

265.95 |

267.70 |

1.75 |

4.69 |

3.0 |

4.71 |

|

P18-1738 |

270/-45 |

|

34.00 |

36.00 |

2.00 |

2.34 |

297.0 |

4.35 |

|

P18-1741 |

270/-88 |

|

33.20 |

36.00 |

2.80 |

2.51 |

2.0 |

2.52 |

|

|

|

|

165.70 |

186.00 |

20.30 |

1.91 |

5.5 |

1.95 |

|

|

|

incl. |

180.00 |

186.00 |

6.00 |

3.38 |

4.3 |

3.41 |

|

P18-1742 |

270/-81 |

|

169.60 |

184.50 |

14.90 |

1.28 |

4.8 |

1.31 |

|

|

|

incl. |

170.80 |

177.00 |

6.20 |

1.73 |

8.2 |

1.79 |

Gold equivalence was calculated using a ratio of 65:1 Ag:Au and Ag recovery of 45.2%.

True width is believed to be approximately 80-90% of reported intercepts.

Unicorn zone

The Unicorn area is a target zone to the northeast of the Big Missouri ridge (see Figure 1). At BM 20, a fan of four drill holes was completed to the north of the Unicorn drill holes reported in the news release of August 9, 2018. Three of the drill holes (1724, 1726 and 1727) hit gold mineralization at relatively shallow depth of less than 50m. The easternmost hole (1724) also intercepted gold mineralization at a deeper level. The Unicorn zone is located on the eastern side of a prominent north-south thrust fault. The orientation of the mineralisation at Unicorn displays a steeper dip than the zones in the Big Missouri ridge. Based on previous drill holes in this zone, there is pattern of mineralization at multiple elevations. Drill results from the Unicorn zone are summarised in Table 3.

Table 3 Summary of the drill results from the Unicorn zone.

|

Hole # |

azimuth/dip |

From (m) |

To |

Width |

Au |

Ag |

AuEq |

|

|

P18-1724 |

90/-50 |

|

42.00 |

44.00 |

2.00 |

5.06 |

2.0 |

5.07 |

|

|

|

|

114.00 |

116.00 |

2.00 |

7.25 |

7.5 |

7.30 |

|

P18-1726 |

270/-55 |

|

18.26 |

35.96 |

17.70 |

2.20 |

8.6 |

2.26 |

|

|

|

incl. |

32.00 |

34.00 |

2.00 |

12.57 |

17.0 |

12.69 |

|

P18-1727 |

270/-70 |

|

19.00 |

20.69 |

1.69 |

5.10 |

7.0 |

5.15 |

Gold equivalence was calculated using a ratio of 65:1 Ag:Au and Ag recovery of 45.2%.

True width is believed to be approximately 80-90% of reported intercepts.

Table 4 Drill pad locations.

|

Pad # |

UTM N |

UTM E |

Elevation |

Hole no. |

|

BM9 |

6219325 |

436277 |

1078 |

1734-1740 |

|

BM10 |

6219425 |

436288 |

1079 |

1715-1718, 1741, 1742 |

|

BM16 |

6219250 |

436286 |

1072 |

1728 |

|

BM17 |

6219271 |

436318 |

1077 |

1709-1714, 1729 |

|

BM20 |

6219575 |

436661 |

978 |

1724-1727 |

|

BM25 |

6219256 |

436516 |

984 |

1719-1723 |

|

BM26 |

6219217 |

436512 |

987 |

1730-1733 |

With this news release, the Company has reported results for 139 drill holes for a total of 28,554m of the 2018 drill campaign at Premier-Dilworth.

Engineering Studies

Several consulting groups have been engaged by the Company in order to provide all relevant data for permitting and preliminary engineering. The hydrogeological drill program has been completed at Premier/Northern Lights and a number of monitoring wells have been installed. Metallurgical composites for confirmatory test work have been collected and arrived at the testing facility. Test commenced in the last week of August.

Good progress is being made in the areas of underground mine design and the determination of operating cost and the cost for refurbishment of the mill.

Change of Auditor

With the changes to the composition of the Company’s Board of Directors (the “Board”) and to management over the past 10 months, the Board has been focused on implementing good corporate governance practices to ensure they are aligned to the strategic direction of the Company. The Board considers that the rotation of auditors should be considered from time to time to help enhance the independence of auditors in providing independent professional services. Therefore, on August 25, 2018, the Company’s Board, determined it was in the Company’s best interest to change auditors. On August 27, 2018, the Company requested that BDO Canada LLP ("BDO") resign as auditor of Ascot Resources Ltd. Effective the same date, the Board appointed PricewaterhouseCoopers LLP (“PWC”) as auditors of the Company until the next annual meeting of the Company. The Company reports that BDO has confirmed there are no reportable events, as defined in National Instrument 51-102, on the financial statements of Ascot Resources Ltd. for the years ended March 31, 2018 and 2017 and that these financial statements did not contain any modifications as to departures from International Financial Reporting Standards or limitation in the scope of the audit. The Audit Committee of the Board has reviewed the letters provided by BDO and PWC and approved the change of auditor notice, each of which will be filed on SEDAR.

Quality Assurance/Quality Control

Lawrence Tsang, P. Geo, the Company’s Project Geologist provides the field management for the Premier exploration program. John Kiernan, P. Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

Analytical work is being carried out by SGS Canada Inc (“SGS”). Ascot’s quality-assurance and quality-control program includes the use of analytical blanks to monitor for cross contamination, certified reference material standards to assess analytical accuracy, and duplicate samples to quantify sampling precision. This is in addition to the internal quality assurance program employed by SGS.

Samples are dried and weighed by SGS. They are then crushed to 75% passing 2mm, with 250g split and pulverized to 85% passing 75µm. Since early June, samples are crushed and split on site by a mobile lab supplied by SGS and run by SGS personnel. All samples are digested using aqua-regia with an ICP-AES finish and fire assay with AA finish for gold. Samples over 100ppm silver are digested with aqua regia and then volumetrically diluted before an ICP-AES or AA finish (up to 1,500ppm). Samples over 1,500ppm silver are fire assayed with a gravimetric finish. Samples over 10ppm gold are fire assayed with a gravimetric finish. Identified or suspected metallic gold or silver are subjected to “metallics” assays. Sampling and storage are at the Company’s secure facility in Stewart.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

"Derek C. White", President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot Resources is a gold and silver focused exploration company with a portfolio of advanced and grassroots projects in the Golden Triangle region of British Columbia. The company’s flagship Premier Project is a near-term high-grade advanced exploration project with large upside potential. Ascot is poised to be the next Golden Triangle producer with an experienced and successful exploration, development and operating team, coupled with a highly regarded major shareholder.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release relative to markets about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding: the anticipated use of proceeds of the Offering, the Company’s 2018 drill program, and the exploration and mineralization potential of the Premier property, are forward-looking statements. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; and uncertainty as to timely availability of permits and other governmental approvals. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.