Vancouver, B.C. September 10, 2019 — Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce the initial results from three exploration drill holes targeting geophysical and deep anomalies southeast of the Big Missouri resource area and south of the Silver Coin deposit. The drill holes intercepted sulfide zones with anomalous gold, silver and base metals at the depth indicated by the geophysical data.

Highlights of this release include:

- 0.67g/t Au and 20.0 g/t Ag over 2.00 metres in hole P19-2049 at Big Missouri

- 0.22g/t Au and 3.1g/t Ag over 10.05 metres in hole P19-2049 at Big Missouri

Derek White, President and CEO of Ascot Resources commented, “A significant portion of the two 16km gold bearing ridges on the Premier property remain underexplored. In 2019, the Company began drill testing some of the geophysical anomalies, which indicated deeper sulfide zones outside the known resources. This exploration technique demonstrates how a geophysical approach can be used to discover new zones of mineralization. In these initial drill holes, the Company identified three new deeper zones that are below 300m from surface, which are areas that have previously never been explored and a new zone south of the Silver Coin deposit on the Indian Ridge. We are excited by these results and see a great opportunity to generate new discoveries. We will expand our exploration efforts in 2019 and plan to use this technique at Red Mountain in the future.”

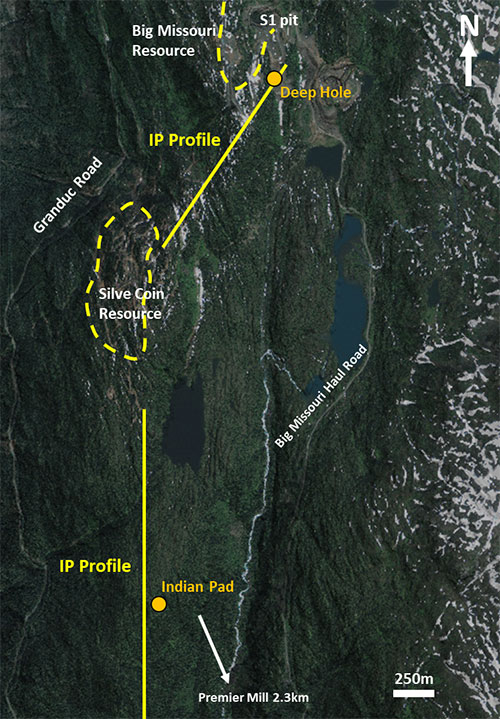

In a previous news release on November 13, 2018, the Company announced that a geophysical survey had identified multiple anomalies outside of the defined resource areas. In May and June of 2019, the Company conducted additional geophysical surveys to better understand the orientation of geophysical anomalies to optimize drill hole design. This news release provides initial results from the first three exploration drill holes that were testing induced polarization targets. Figure 1 shows the location of the two drill pads used to test a deep target south of the S1 pit at Big Missouri and a target on the ridge south of Silver Coin.

Deep Hole Southeast of Big Missouri

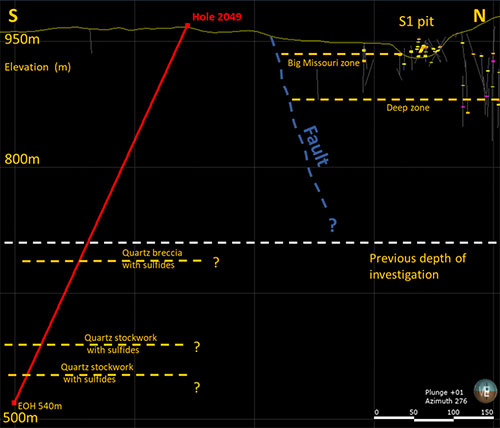

This drill hole was designed to test a deep induced polarization target and at the same time to test the deeper parts of the stratigraphy at the prolific Big Missouri Ridge. The drill hole intercepted andesitic flows and flow breccias with interbedded tuff layers known from previous drilling. At 300 metres depth, the hole penetrated the previous maximum depth of investigation at the ridge and continued through prospective stratigraphy until terminated at 540 metres total depth (see Figure 2). The drill hole intersected a quartz breccia with disseminated pyrite and altered andesite with quartz stockwork and pyrite starting at 337.5m depth coinciding well with the depth of the geophysical anomaly. This interval is highlighted by a two-metre interval of 0.21g/t Au with anomalous zinc and lead (see Table 1). At 425 metres depth, the hole intercepted altered Premier porphyry with quartz stockwork and disseminated sulfides. The porphyry contains two metres of 0.67g/t gold and 20g/t silver. Another porphyry interval around 500 metres depth intercepted ten metres of 0.22g/t gold. The drill hole intercepted three new zones of anomalous gold mineralization below and in addition to the three known zones at the Big Missouri Ridge. This demonstrates the prospective nature of the deep parts of the stratigraphy along the entire ridge and opens a large area for exploration at depth.

Figure 1 - Location map showing the two exploration drill pads

Figure 2 - Schematic cross section showing the deep hole at Big Missouri

Exploration Results at the Indian Ridge

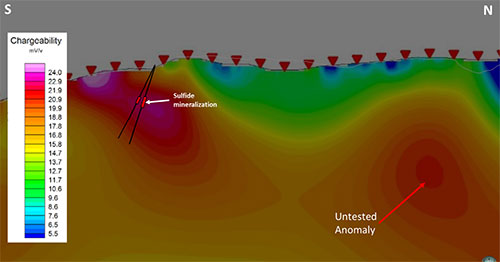

One of the IP profiles completed in 2019 stretches over 2,000m from the Silver Coin resource to the south (see Figure 1). Figure 3 shows the resulting chargeability section, depicting a strong IP anomaly in the center of the profile and two drill holes that are testing the target. The anomaly is located approximately 1,500m south of the Silver Coin resource solids and 2,300m northwest of the Premier mill. The drill holes intersected sulfide mineralization at the exact depth that the inversion of the geophysical data suggests. The mineralization is hosted by quartz breccia and stockwork with disseminated pyrite, galena and sphalerite with anomalous amounts of gold and silver (see Table 1). The mineralization is visibly indistinguishable of the ore zones at Premier and Big Missouri. These established resource areas also contain low grade zones with visible base metal mineralization but relatively low grades of precious metals. These low-grade zones can be immediately adjacent to high grade shoots. Additional drill holes will be necessary to fully assess the character of the newly discovered zone at Indian.

Figure 3 Inversion of chargeability data from induced polarization survey showing the drill holes at the Indian ridge. There is an untested anomaly to the north of the drill holes that is expected to be tested before the end of the field season.

Table 1 Summary of exploration drill results from the Indian Ridge

| Hole # | From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

Zn (%) |

Pb (%) |

| P19-2042 | 108.66 | 109.25 | 0.59 | 0.12 | 6.0 | 0.46 | 0.06 |

| 121.25 | 123.25 | 2.00 | 0.18 | 5.0 | 0.10 | 0.03 | |

| P19-2049 | 362.00 | 364.00 | 2.00 | 0.21 | 8.0 | 0.37 | 0.23 |

| 431.00 | 433.00 | 2.00 | 0.36 | 6.0 | 0.18 | 0.08 | |

| 441.00 | 443.00 | 2.00 | 0.67 | 20.0 | 0.28 | 0.18 | |

| 497.95 | 508.00 | 10.05 | 0.22 | 3.11 | 0.10 | 0.04 | |

| incl. | 497.95 | 499.00 | 1.05 | 0.49 | 8.0 | 0.50 | 0.19 |

| P19-2050 | 103.71 | 105.00 | 1.29 | 0.04 | 9.0 | 2.54 | 0.01 |

True width is not known at this point as the orientation of the zones has not been defined. It will be less than the width indicated in the table.

Table 2 Drill hole location and orientation

| Hole # | Pad # | UTM N | UTM E | Elevation | Azimuth/Dip |

| P19-2042 | Indian | 6219325 | 436292 | 1074 | 235/-50 |

| P19-2049 | Deep Hole | 6219129 | 436606 | 967 | 178/-65 |

| P19-2050 | Indian | 6219325 | 436292 | 1074 | 235/-60 |

Quality Assurance/Quality Control

Lawrence Tsang, P. Geo, the Company’s Senior Geologist provides the field management for the Premier exploration program. John Kiernan, P. Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

Analytical work is being carried out by SGS Canada Inc (“SGS”). Ascot’s quality-assurance and quality-control program includes the use of analytical blanks to monitor for cross contamination, certified reference material standards to assess analytical accuracy, and duplicate samples to quantify sampling precision. This is in addition to the internal quality assurance program employed by SGS.

Samples are dried and weighed by SGS. They are then crushed to 75% passing 2mm, with 250g split and pulverized to 85% passing 75µm. Samples are processed on site by a mobile lab supplied by SGS and run by SGS personnel. All splits are sent to SGS in Burnaby. There, all samples are digested using aqua-regia with an ICP-AES finish and fire assay with AA finish for gold. Samples over 100ppm silver are digested with aqua regia and then volumetrically diluted before an ICP-AES or AA finish (up to 1,500ppm). Samples over 1,500ppm silver are fire assayed with a gravimetric finish. Samples over 10ppm gold are fire assayed with a gravimetric finish. Identified or suspected metallic gold or silver are subjected to “metallics” assays. Sampling and storage are at the Company’s secure facility in Stewart.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com or www.ascotgold.com

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot is a Canadian-based junior exploration company focused on re-starting the past producing historic Premier gold mine, located in British Columbia's Golden Triangle. The Company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier project). Ascot's acquisition of IDM Mining added the high-grade gold and silver Red Mountain project to its portfolio and positions the Company as a leading consolidator of high- quality assets in the Golden Triangle.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Ascot can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Ascot’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the estimated costs associated with construction of the Premier and Red Mountain Projects; the timing of the anticipated start of production at the Premier and Red Mountain Projects; the ability to maintain throughput and production levels at the Premier Mill; and the Companies' ability to achieve the synergies expected as a result of the Transaction. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include risks associated with the business of Ascot; risks related to exploration and potential development of Ascot’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in Ascot’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements.