Vancouver, B.C. August 27, 2019 — Ascot Resources Ltd (TSX.V: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce the fifth set of results from its 2019 drill program at the Premier Project (“Premier”) near Stewart in northwestern British Columbia.

Highlights of this release include:

- 69.00g/t Au over 0.85m in hole P19-1981 at Big Missouri

- 12.80g/t Au over 1.54in hole P19-1985 at Big Missouri

- 11.80g/t Au over 2.0m in hole P19-1991 at Big Missouri

The Company commenced its 2019 drill program in April and has released four batches of results so far. This news release summarizes the results from the fifth batch of 23 drill holes of the 2019 program. All holes were drilled in the vicinity of the S1 pit at the Big Missouri Ridge located about 5km to the north of the Premier mill.

Drill Results

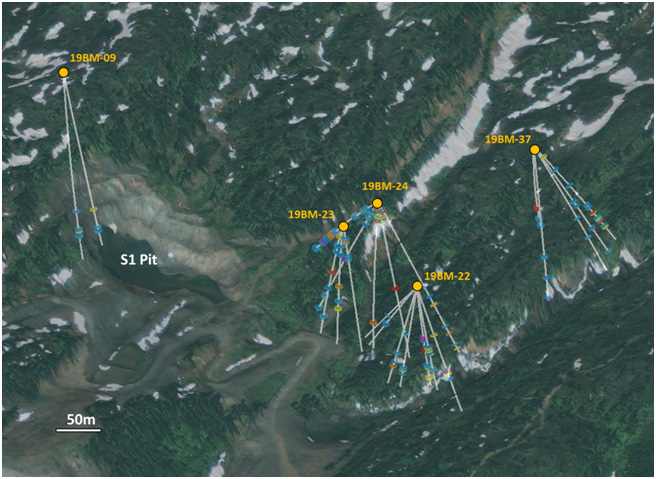

This news release presents the results from 23 drill holes, comprising 3,321 metres of drilling, completed from five separate pads to the west (19BM-09) and northeast (19BM-22, 19BM-23, 19BM-24 and 19BM-37) of the historic S1 pit (see Figure 2). The results from these drill holes are summarized in Table 1 and the pad locations are listed in Table 2.

The drill holes from pad 19BM-09 complete a large infill pattern that seeks to upgrade the classification of the mineralized zone to the west and southwest of the S1 pit where Westmin mined the Big Missouri zone in the 1990s until the strip ratio became prohibitive in this pit. The aim of the program was to consolidate the resources in this area and to define a contiguous resource for underground mining purposes. The infill program is necessary to upgrade a part of the inferred resources at Premier to the indicated category in order to qualify these resources for conversion to reserves in upcoming engineering studies prior to project financing. Under current regulations inferred resources are not eligible to be converted to reserves in the course of a feasibility study.

The drill holes from the other four pads aim to achieve the same purpose on the other side of the existing pit. Mineralization in this area is relatively close to surface and has previously not been defined as well as the area to the west of the pit. The infill drilling has established contiguous zones in this area and continues to hit high-grade gold at predictable depths.

At the time of writing the drilling at Big Missouri has been completed and two rigs are turning at Silver Coin where over 80% of the infill pattern is completed. Initial drill results from this area that was acquired by Ascot in late 2018 should be available for reporting shortly. One drill rig is currently turning at the Prew zone near the Premier mill and a second rig will be added there when it has completed its tasks at Silver Coin. The fourth rig is testing exploration targets.

Figure 1 Image of the S1 pit area at Big Missouri looking northwest showing the location of the drill pads discussed in this release. The drill holes for each pad are listed in Table 2.

Table 1 Summary of drill results from Big Missouri

| Hole # | pad | azimuth/dip | From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

|---|---|---|---|---|---|---|---|

| P19-1978 | 19-BM9 | 090/-78 | 162.80 | 163.90 | 1.10 | 3.73 | 7.0 |

| also | 187.80 | 190.10 | 2.30 | 1.42 | 6.0 | ||

| P19-1979 | 19-BM9 | 090/-87 | 187.60 | 197.60 | 10.00 | 1.35 | 2.8 |

| incl. | 189.60 | 191.60 | 2.00 | 2.41 | 4.0 | ||

| P19-1980 | 19-BM24 | 270/-43 | 23.80 | 25.15 | 1.35 | 1.63 | 11.0 |

| also | 36.26 | 37.26 | 1.00 | 1.14 | 24.0 | ||

| P19-1981 | 19-BM24 | 270/-64 | 14.56 | 16.56 | 2.00 | 1.70 | 16.5 |

| also | 18.50 | 19.50 | 1.00 | 1.56 | 16.0 | ||

| also | 24.10 | 26.10 | 2.00 | 1.33 | 5.5 | ||

| also | 34.10 | 35.10 | 1.00 | 1.63 | 9.0 | ||

| also | 89.20 | 90.05 | 0.85 | 69.00 | 51.5 | ||

| also | 144.17 | 148.17 | 4.00 | 1.97 | 4.5 | ||

| P19-1982 | 19-BM24 | 270/-89 | 8.61 | 12.61 | 4.00 | 1.92 | 6.1 |

| incl. | 8.61 | 9.61 | 1.00 | 4.99 | 9.5 | ||

| also | 17.61 | 18.61 | 1.00 | 3.56 | 9.0 | ||

| also | 23.62 | 24.62 | 1.00 | 6.66 | 8.0 | ||

| also | 145.65 | 147.65 | 2.00 | 4.48 | 11.0 | ||

| P19-1983 | 19-BM24 | 090/-60 | 12.09 | 13.09 | 1.00 | 9.51 | 14.0 |

| also | 125.40 | 127.40 | 2.00 | 3.74 | 8.8 | ||

| also | 161.35 | 162.16 | 0.81 | 4.20 | 3.0 | ||

| also | 179.16 | 180.16 | 1.00 | 2.26 | 3.0 | ||

| P19-1984 | 19-BM24 | 090/-78 | 17.98 | 19.98 | 2.00 | 2.48 | 12.5 |

| also | 23.90 | 24.90 | 1.00 | 2.03 | 8.0 | ||

| also | 99.76 | 101.76 | 2.00 | 7.67 | 4.0 | ||

| P19-1985 | 19-BM22 | 360/-81 | 64.00 | 65.54 | 1.54 | 12.80 | 15.0 |

| also | 80.00 | 81.21 | 1.21 | 6.69 | 19.0 | ||

| also | 99.00 | 103.50 | 4.50 | 1.54 | 20.0 | ||

| also | 115.00 | 117.00 | 2.00 | 2.74 | 7.0 | ||

| P19-1986 | 19-BM22 | 275/-53 | 72.00 | 73.00 | 1.00 | 1.80 | 11.0 |

| P19-1987 | 19-BM22 | 225/-43 | 43.45 | 44.45 | 1.00 | 1.67 | 33.0 |

| P19-1988 | 19-BM22 | 210/-72 | 77.44 | 81.00 | 3.56 | 1.28 | 6.9 |

| also | 93.00 | 94.27 | 1.27 | 5.42 | 4.0 | ||

| P19-1989 | 19-BM22 | 185/-75 | 89.17 | 93.50 | 4.33 | 1.53 | 18.8 |

| P19-1990 | 19-BM22 | 085/-69 | 55.54 | 57.00 | 1.46 | 2.62 | 11.0 |

| also | 95.22 | 102.41 | 7.19 | 3.85 | 20.5 | ||

| incl. | 96.32 | 99.36 | 3.04 | 6.34 | 33.0 | ||

| P19-1991 | 19-BM23 | 285/-43 | 18.00 | 52.00 | 34.00 | 2.04 | 9.7 |

| incl. | 24.19 | 26.00 | 1.81 | 5.56 | 3.0 | ||

| and | 44.00 | 46.00 | 2.00 | 11.80 | 8.0 | ||

| P19-1992 | 19-BM22 | 078/-80 | 71.85 | 75.64 | 3.79 | 2.35 | 15.6 |

Table 1 Continued

| Hole # | pad | azimuth/dip | From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

|---|---|---|---|---|---|---|---|

| P19-1993 | 19-BM37 | 326/-59 | 124.05 | 125.30 | 1.25 | 9.03 | 14.0 |

| also | 146.50 | 150.50 | 4.00 | 1.25 | 3.5 | ||

| P19-2001 | 19-BM37 | 090/-82 | 126.40 | 129.40 | 3.00 | 1.41 | 3.0 |

| P19-2002 | 19-BM37 | 083/-52 | 89.05 | 91.05 | 2.00 | 1.26 | 18.0 |

| P19-2003 | 19-BM37 | 066/-47 | 15.37 | 17.37 | 2.00 | 2.38 | 28.0 |

| also | 57.14 | 59.14 | 2.00 | 1.82 | 8.0 | ||

| also | 96.42 | 110.95 | 14.53 | 2.96 | 24.5 | ||

| incl. | 96.42 | 97.42 | 1.00 | 6.27 | 45.0 | ||

| and | 108.91 | 110.95 | 2.04 | 9.06 | 15.0 | ||

| also | 116.50 | 118.50 | 2.00 | 2.15 | 5.0 | ||

| P19-2004 | 19-BM37 | 050/-58 | 78.60 | 80.60 | 2.00 | 1.32 | 23.0 |

| P19-2006 | 19-BM23 | 090/-80 | 13.60 | 20.00 | 6.40 | 2.11 | 8.7 |

| incl. | 18.00 | 20.00 | 2.00 | 4.47 | 9.0 | ||

| P19-2007 | 19-BM23 | 270/-76 | 14.21 | 15.21 | 1.00 | 3.95 | 7.0 |

| also | 61.30 | 62.86 | 1.56 | 8.36 | 9.0 | ||

| P19-2008 | 19-BM23 | 270/-86 | 73.67 | 75.67 | 2.00 | 4.68 | 14.0 |

| also | 100.95 | 102.95 | 2.00 | 3.09 | 6.0 |

True width is believed to be approximately 70-90% of reported intercepts. The drill hole numbers that are missing in the sequence have assays pending.

Table 2 Drill pad locations

| Pad # | UTM N | UTM E | Elevation | Hole no. |

|---|---|---|---|---|

| 19BM-09 | 6219375 | 436295 | 1082 | 1978, 1979 |

| 19BM-22 | 6219540 | 436778 | 954 | 1985-1990, 1992 |

| 19BM-23 | 6219575 | 436662 | 979 | 1991, 2006-2008 |

| 19BM-24 | 6219625 | 436673 | 989 | 1980-1984 |

| 19BM-37 | 6219775 | 436772 | 1018 | 1993, 2001-2004 |

Quality Assurance/Quality Control

Lawrence Tsang, P. Geo, the Company’s Senior Geologist provides the field management for the Premier exploration program. John Kiernan, P. Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

Analytical work is being carried out by SGS Canada Inc (“SGS”). Ascot’s quality-assurance and quality-control program includes the use of analytical blanks to monitor for cross contamination, certified reference material standards to assess analytical accuracy, and duplicate samples to quantify sampling precision. This is in addition to the internal quality assurance program employed by SGS.

Samples are dried and weighed by SGS. They are then crushed to 75% passing 2mm, with 250g split and pulverized to 85% passing 75µm. Samples are processed on site by a mobile lab supplied by SGS and run by SGS personnel. All splits are sent to SGS in Burnaby. There, all samples are digested using aqua-regia with an ICP-AES finish and fire assay with AA finish for gold. Samples over 100ppm silver are digested with aqua regia and then volumetrically diluted before an ICP-AES or AA finish (up to 1,500ppm). Samples over 1,500ppm silver are fire assayed with a gravimetric finish. Samples over 10ppm gold are fire assayed with a gravimetric finish. Identified or suspected metallic gold or silver are subjected to “metallics” assays. Sampling and storage are at the Company’s secure facility in Stewart.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com.

ON BEHALF OF THE BOARD OF DIRECTORS OF

ASCOT RESOURCES LTD.

“Derek C. White”, President and CEO

For further information contact:

Kristina Howe

VP, Investor Relations

778-725-1060 / khowe@ascotgold.com

About Ascot Resources Ltd.

Ascot is a Canadian-based junior exploration company focused on re-starting the past producing historic Premier gold mine, located in British Columbia's Golden Triangle. The Company continues to define high-grade resources for underground mining with the near-term goal of converting the underground resources into reserves, while continuing to explore nearby targets on its Premier/Dilworth and Silver Coin properties (collectively referred to as the Premier project). Ascot's acquisition of IDM Mining added the high-grade gold and silver Red Mountain project to its portfolio and positions the Company as a leading consolidator of high- quality assets in the Golden Triangle.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements, trend analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since the Ascot can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in the Ascot’s periodic filings with Canadian securities regulators, and assumptions made with regard to: the estimated costs associated with construction of the Premier and Red Mountain Projects; the timing of the anticipated start of production at the Premier and Red Mountain Projects; the ability to maintain throughput and production levels at the Premier Mill; and the Companies' ability to achieve the synergies expected as a result of the Transaction. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Ascot’s expectations include risks associated with the business of Ascot; risks related to exploration and potential development of Ascot’s projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and native groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in Ascot’s filings with Canadian securities regulators on SEDAR in Canada (available at www.sedar.com). Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Ascot does not undertake any obligation to update forward-looking statements.