Red Mountain Project

The Red Mountain Project (“RMP”) is located 15km northeast of the town of Stewart near the headwaters of the Bitter Creek Valley within Nisga'a Nation traditional territory. The Project was advanced by IDM Mining Ltd. between 2014 and 2019. A substantial deposit of high-grade gold has been delineated, primarily in the Measured and Indicated category and is accessed by 2,000 meters of production-sized underground workings. With an average thickness of 15 meters and up to 40 meters in areas, and with excellent ground conditions, the deposit is primarily amenable to low-cost longhole stoping. The Red Mountain Project received a Provincial Environmental Assessment Certificate on October 5, 2018 and a Federal Environmental Assessment Certificate on January 14, 2019. On March 28, 2019, RMP was purchased by Ascot and on April 10, 2019, the Company signed a Benefits Agreement with the Nisga’a Lisms Government.

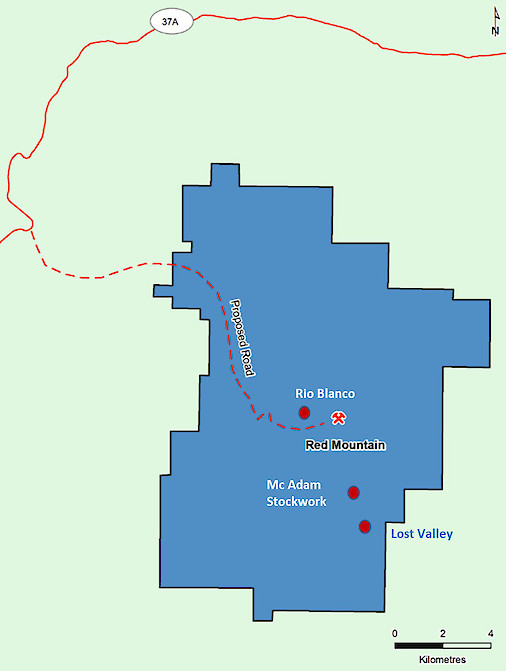

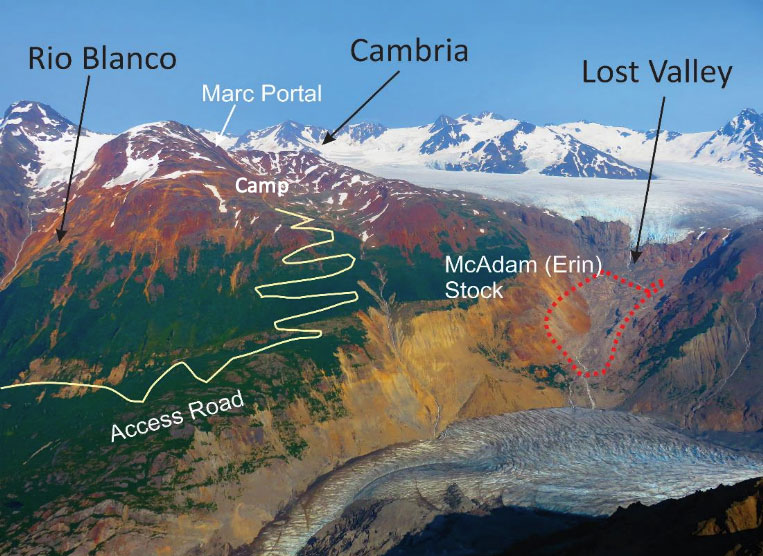

The RMP ground comprises 17,125 hectares with prospective geology suitable for the discovery of high-grade gold deposits of multiple mineralization styles. There are multiple exploration targets at RMP, including Lost Valley, where a new discovery was exposed by receding glaciers. Resources at Red Mountain remain open for expansion in multiple directions.

The RMP resources are as follows:

Mineral Resource Estimate

The updated mineral resources for the Red Mountain Project are reported at a 3.0 g/t Au cut-off for underground longhole stoping mining methods.

The mineral resource model prepared by ACS utilised a total of 699 drill holes, 230 of which were drilled by IDM Mining: 12 in 2014, 62 in 2016, 116 in 2017 and 40 in 2018. The resource estimation work was completed by Dr. Gilles Arseneau, P. Geo. (EGBC) an appropriate independent “qualified person” within the meaning of NI 43-101. The effective date of the Mineral Resource statement is August 30, 2019

| Class | In situ Tonnes 000's |

Average In situ Grades |

Contained oz (000's) |

||

| Au g/t | Ag g/t | Au | Ag | ||

| Measured | 1,920 | 8.81 | 28.30 | 543,800 | 1, 747,000 |

| Indicated | 1,298 | 5.85 | 10.01 | 238,800 | 408,800 |

| Total M&I | 1,271 | 7.63 | 21.02 | 782,600 | 2,155,800 |

| Inferred | 405 | 5.32 | 7.33 | 69,300 | 95,500 |

Notes for above:

- Red Mountain Resources are reported at a 3.0 g/t Au cut-off

- The Red Mountain Gold Project arise from the press release dated October 31, 2019 authored by Gilles Arsenault, P.Geo, a Qualified Person as defined by NI 43-101 as filed on Sedar.

- The effective date and report date and of the NI 43-101 report are; August 30, 2019 and November 22, 2019, respectively

- Numbers may not sum due to rounding

Infrastructure

Red Mountain is only accessible by helicopter and the property has a 45-person winterized camp, which can be used year-round. The site also has 2,000 meters of 5 by 5 meter underground workings, surface and underground mining equipment and shop facilities, and diesel power generation. The Company is currently working on the application for an access road to connect to highway 37A to be used for exploration and underground bulk sampling purposes. The figure below shows the general layout of Red Mountain.

Management's Outlook

Since acquiring the Red Mountain project in March of 2019, management has focused on updating the historic 2017 Feasibility Study for both as a standalone operation and as an integrated satellite deposit for the Premier mill. The resource was updated in the fall of 2019 and mine planning and capital estimates on a standalone basis and as integrated deposit using the Premier infrastructure have significantly progressed. This work will form part of an integrated Feasibility Study expected by the end of March, 2020.

History of the Property

The deposit was discovered in 1989 and the property was explored extensively until 1996 by Lac Minerals Ltd. and Royal Oak Mines Ltd. with a total of 466 diamond drill holes and over 2,000 meters of underground development, along with extensive engineering and environmental baseline work. Additional studies, but no additional drilling was performed from 1996-2014 by Seabridge Gold Inc, North American Metals Corp. and three holes were completed by Banks Island Gold Ltd.

In April 2014, IDM Mining Ltd. entered into an option agreement and subsequently acquired the Red Mountain Project from Seabridge Gold Inc. IDM rehabilitated the surface and underground infrastructure and significantly expanded and upgraded resources, as well as receiving federal and provincial EA approval. In March 2019, IDM was acquired by Ascot Resources who now owns 100% of the Red Mountain Project, subject to underlying agreements and royalties. Seabridge will have the right to acquire 10% of the annual production from Red Mountain at a cost of US$1,000/oz capped at a maximum of 50,000 ounces. They can elect to receive a one-time cash payment of $4 million at commencement of production in exchange for the buy-back of the gold metal stream interest.