Vancouver, B.C. May 15, 2023 — Ascot Resources Ltd. (TSX: AOT; OTCQX: AOTVF) (“Ascot” or the “Company”) is pleased to announce the Company’s unaudited financial results for the three months ended March 31, 2023 (“Q1 2023”), and also to provide a construction update on the Company’s Premier Gold Project (“PGP” or the “project”), located on Nisga’a Nation Treaty Lands in the prolific Golden Triangle of northwestern British Columbia. For details of the unaudited condensed interim consolidated financial statements and Management's Discussion and Analysis for the three months ended March 31, 2023, please see the Company’s filings on SEDAR (www.sedar.com).

Derek White, President and CEO, commented, "As a result of the construction financing closed earlier this year, and also the momentum started with last year’s construction season, work crews have hit the ground running in the first quarter of 2023 with much progress being made in many areas. In mid-January contractors started inside the mill building and progressed piping and equipment installations, and outdoor construction has recently been advancing the new water treatment plant and associated infrastructure. As of Q1 2023, detailed engineering stands at 99% complete, major procurement is over 95% complete, and project construction excluding mine development is at 35%. We plan to further ramp-up construction efforts in the coming months with the mobilization of the earthworks and underground mining contractors and continue to advance project development towards initial gold pour in early 2024.”

All amounts herein are reported in $000s of Canadian dollars (“C$”) unless otherwise specified.

Q1 2023 AND RECENT HIGHLIGHTS

- On January 19, 2023, the Company closed a previously announced financing package for completion of construction of the Project. The financing package consists of US$110 million as a deposit in respect of gold and silver streaming agreements (the “Stream”) and a strategic equity investment (the “Strategic Investment”) of C$45 million, a portion of which is structured as Canadian Development Expenditures flow through shares, such that the total gross proceeds to the Company was C$50 million. Concurrent with the closing of the financing package, the outstanding principal and accrued interest of the Senior Debt with Sprott Private Resource Lending II (CO) Inc. (“Sprott Lending”) was repaid, the Production Payment Agreement (“PPA”) in connection with the Senior Debt was terminated and the existing gold stream from the Red Mountain property with Sprott Private Resource Streaming and Royalty (B) Corp. (“Sprott Streaming”) was terminated and replaced by the new gold and silver stream.

- The Premier site was preserved and winterized in late 2022. The Company recommenced its construction activities in early 2023 by re-mobilizing various construction contractors to site to complete the remaining scope on mill construction and piping. Construction of the new water treatment plant began in Q1 2023. Earthworks on tailings and the construction of the new water treatment plant will commence in Q2 2023 once the snow has melted.

- On February 17, 2023, the Company reorganized its Board of Directors (“Board”) by adding two new members: José Néstor Marún and Stephen Altmann, both of whom were appointed pursuant to the recently Strategic Investment with Ccori Apu S.A.C. (“Ccori Apu”). The Company also reported the voluntary resignation of Ken Carter and James Stypula from Ascot’s Board. As a result, Ascot’s Board maintains its size of seven directors, and its gender diversity with 29% women.

- On March 23, 2023, the Company published its second annual Sustainability Report, which will continue to evolve as Ascot progresses from development into production next year. The 2022 Sustainability Report can be accessed and downloaded at https://ascotgold.com/sustainability/sustainability-reports/

- On April 20, 2023, the Company closed a previously announced non-brokered private placement (the “Offering”). The Offering raised total gross proceeds of $4,050 and consisted of 5,000,000 common shares of the Company, which qualify as "flow-through shares" within the meaning of the Income Tax Act (Canada) (the “FT Shares”), at a price of C$0.81 per FT Share. The proceeds from the Offering will be used to fund the 2023 exploration program at PGP. The gross proceeds from the issuance of the FT Shares will be used for “Canadian exploration expenses”, and will qualify as “flow-through mining expenditures” as those terms are defined in the Income Tax Act (Canada), which will be renounced to the purchaser of the FT Shares with an effective date no later than December 31, 2023 in an aggregate amount not less than the gross proceeds raised from the issue of the FT Shares.

- On May 11, 2023, the Company announced the 2023 exploration program at PGP. The program consists of an initial 10,000 metres of surface drilling and will include exploration drilling for resource expansion as well as in-fill drilling of early mining areas at the Big Missouri and Premier deposits. The exploration drilling will focus on extending the Day Zone at Big Missouri and the Sebakwe Zone north of the Premier mill. Up to an additional 4,000 meters of drilling have been budgeted and will be deployed towards surface and underground drilling depending on results of the initial 10,000 metres.

PROJECT CONSTRUCTION

Upon securing the new project financing in January 2023, Ascot re-engaged various contractors to progress activities in the mill building for the remainder of mill construction scope. Starting from approximately 65 people working at site at the end of January, there are now approximately 130 workers on site, and this will continue to increase with the mobilization of earthworks and mining contractors in the coming months to a peak of approximately 200 workers on site.

At the end of Q1 2023, detailed engineering was at 99% completion. Major procurement was more than 95% complete. Key orders remaining in the plant relate mostly to piping, instrumentation and bulk consumables.

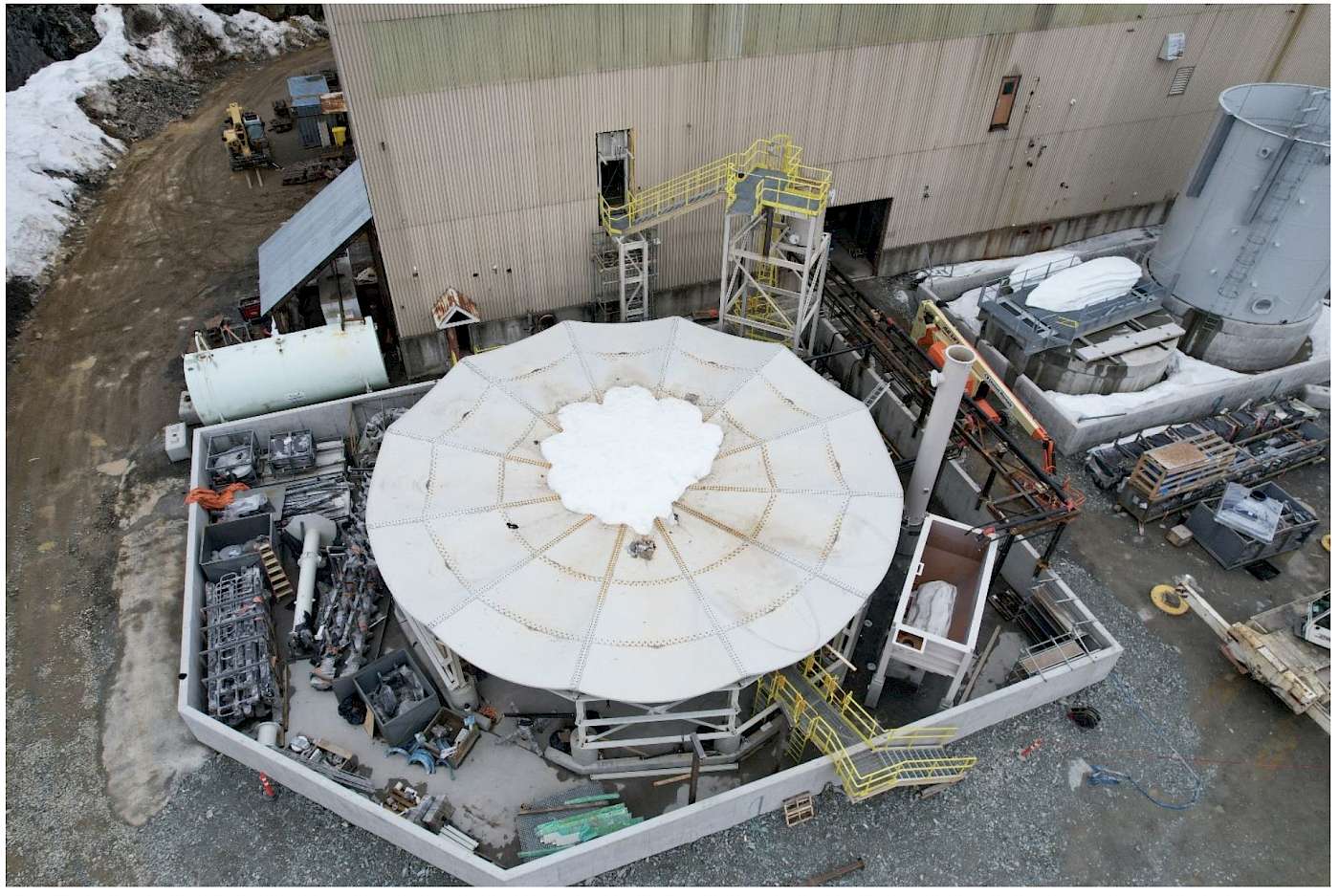

Mechanical work continued in the mill; various trommels, dust collection and chute infrastructure were installed around the SAG and Ball mills. The Intensive Leach Reactor was assembled. Electricians continued installing electrical cabinetry, pulling wire, installing cable trays, and working in the MCC room. Concrete and structural steel contractors also have been restarted and their scope updated for the mill completion. Crews have also made progress on the new water treatment plant (“WTP”) and associated infrastructure, including the tailings thickener, lime silos, moving bed bio-reactor (“MBBR”) tanks, and clarifier foundation pedestals.

The earthworks contract was signed in March 2023. In order to de-water the tailings facility for the required upcoming earthworks, an additional temporary water treatment plant has been mobilized to site. This temporary de-watering will occur for a period of approximately 4-6 weeks. By the end of May 2023, the earthworks contractor will be mobilized to re-start work on the Cascade Creek Diversion Channel (“CCDC”) and tailings facility, which is anticipated to be completed by October 2023.

At the end of Q1 2023, overall construction excluding mine development was at 35.3% completion. By the end of 2022, Ascot had invested a total of approximately C$153 million in construction of PGP. By March 31, 2023, Ascot had spent C$173 million on the project. Ascot’s cash balance at March 31, 2023 was C$149 million.

UNDERGROUND MINE DEVELOPMENT

Mine plan and sequencing optimization were completed in October 2022, developing a plan to minimize upfront development while accessing early ore in an optimized sequence starting at Premier Northern Lights (“PNL”) then ramping up production at Big Missouri (“BM”), while developing over to Silver Coin (“SC”), where the upper levels of the deposit will be initially developed to maximize ore tonnage per linear metre. Based on the recently completed plan, we anticipate starting mine development in late July 2023 with the collaring of the PNL ramp portal, while development will recommence at BM in late September 2023, after completion of the plug on the 2350 level in August 2023. Engineering on a pipe and valve assembly for the 2350 plug design that was approved in February 2023 is in progress.

Limitations on ore storage on surface have resulted in a realignment of the mine plan. The initial focus in PNL will be “just in time” with long-hole drilled inventory blasted as required, while more priority will be put on BM in the early plan because material can be stored in the Dago Pit and brought to the temporary mill pad from there. The realignment of the mine plan is expected to complete by the end of mid-June 2023.

A consultant continued work on underground ventilation plans in Ventsim for all three mine areas, developing a unique plan to use the historical workings in conjunction with a “pull” system near the PNL portal. This work and the SC/BM system will be finalized and added to the updated mine plan.

Ascot is currently in the process of finalizing a mining contract with a mine contractor for development and initial production, this process will be completed during Q2 2023.

Mine development will progress throughout 2023 and delivery of ore is expected to commence late in the fourth quarter of 2023, enabling the start of mill commissioning and first gold pour in early 2024.

FINANCIAL RESULTS FOR THE THREE MONTHS ENDED MARCH 31, 2023

The Company reported a net loss of $7,589 for Q1 2023 compared to $1,370 for Q1 2022. The higher net loss in Q1 2023 is driven by a $4,202 loss on extinguishment of Senior Debt, $1,430 change in fair value of derivatives and $1,127 in fees and expenses associated with Stream.

LIQUIDITY AND CAPITAL RESOURCES

As at March 31, 2023, the Company had cash & cash equivalents of $149,261 and working capital of $131,631 excluding the current portion of the credit facilities. In Q1 2023, the Company issued 109,208,928 common shares, 400,000 stock options, and 18,963 Deferred Share Units. Also, 500,000 stock options expired unexercised and 55,530 stock options and 653,398 Restricted Share Units were exercised in Q1 2023.

MANAGEMENT’S OUTLOOK FOR 2023

With the financing package closed on January 19, 2023, the Company believes that it has sufficient funding to complete construction of the Project and achieve first gold production in early 2024. The key activities for 2023 include:

- During Q1 2023, contractors were re-mobilized to the mill and significant progress has been made since then in the area of mechanical installation, piping, electrical and related surface infrastructure

- Construction of the process plant and associated surface infrastructure such that the plant is expected to be in pre-commissioning by the end of 2023

- Completion of the tailings dam improvements and start up of the new water treatment plant by Q4 2023, and in order to facilitate the dewatering of the tailing dam for construction, a temporary water treatment plant has been installed and dewatering activities are planned for the month of May, June and July 2023

- Advancement of the PNL portal and underground development and additional underground development of the Big Missouri mine

- Maintaining a Health and Safety record of zero lost time incidents and achieving the 2023 goals outlined in the Company’s 2022 Sustainability Report

- Advancing the recruitment of site personnel in line with the site personnel plan by the end of 2023

- Maintaining permitting and environmental compliance so that there are no delays in the project construction schedule

- More exploration and infill drilling north and west of existing resources

2023 AGM PRESENTATION WEBCAST

Ascot’s Annual General Meeting (“AGM”) is taking place on Thursday, June 22 at 10:00 AM PST. Please join President & CEO Derek White for a presentation via webcast at 1:15 PM PST for the results of the AGM and an overview of Ascot’s progress and plans in 2023. Please join 5 to 10 minutes prior to the scheduled time.

Time: Thursday, June 22, 2023, at 1:15PM PT

Webcast: https://services.choruscall.ca/links/ascot20230622.html

Telephone: toll free Canada/USA 1‐800‐319‐4610; International 1‐604‐638‐5340

CONSTRUCTION PROGRESS PHOTOS

Figure 1 – Mill building mechanical equipment installation

Figure 2 – Mill building top floor mechanical equipment installation

Figure 3 – Tailings thickener construction

Figure 4 – Temporary WTP for tailings facility Spring water discharge

Figure 5 – New WTP lime silos installed

Figure 6 – New WTP clarifier foundation pedestals installed

Figure 7 – New WTP MBBR tanks installed

Figure 8 – Electrical substation foundation construction

Qualified Person

John Kiernan, P.Eng., Chief Operating Officer of the Company is the Company’s Qualified Person (QP) as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

On behalf of the Board of Directors of Ascot Resources Ltd.

“Derek C. White”

President & CEO

For further information contact:

David Stewart, P.Eng.

VP, Corporate Development & Shareholder Communications

dstewart@ascotgold.com

778-725-1060 ext. 1024

About Ascot Resources Ltd.

Ascot is a Canadian junior exploration and development company focused on re-starting the past producing Premier gold mine, located on Nisga’a Nation Treaty Lands, in British Columbia’s prolific Golden Triangle. Ascot shares trade on the TSX under the ticker AOT. Concurrent with progressing the development of Premier, the Company continues to successfully explore its properties for additional high-grade underground resources. Ascot is committed to the safe and responsible development of Premier in collaboration with Nisga’a Nation as outlined in the Benefits Agreement.

For more information about the Company, please refer to the Company’s profile on SEDAR at www.sedar.com or visit the Company’s web site at www.ascotgold.com, or for a virtual tour visit www.vrify.com under Ascot Resources.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

All statements and other information contained in this press release about anticipated future events may constitute forward-looking information under Canadian securities laws ("forward-looking statements"). Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect", "targeted", "outlook", "on track" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein are forward-looking statements, including statements in respect of the advancement and development of the PGP and the timing related thereto, the exploration of the Company’s properties and management’s outlook for the remainder of 2023 and beyond. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including risks associated with the business of Ascot; risks related to exploration and potential development of Ascot's projects; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and indigenous groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; risks associated with COVID-19 including adverse impacts on the world economy, construction timing and the availability of personnel; and other risk factors as detailed from time to time in Ascot's filings with Canadian securities regulators, available on Ascot's profile on SEDAR at www.sedar.com including the Annual Information Form of the Company dated March 23, 2023 in the section entitled "Risk Factors". Forward-looking statements are based on assumptions made with regard to: the estimated costs associated with construction of the Project; the timing of the anticipated start of production at the Project; the ability to maintain throughput and production levels at the Premier Mill; the tax rate applicable to the Company; future commodity prices; the grade of Resources and Reserves; the ability of the Company to convert inferred resources to other categories; the ability of the Company to reduce mining dilution; the ability to reduce capital costs; and exploration plans. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Although Ascot believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since Ascot can give no assurance that such expectations will prove to be correct. Ascot does not undertake any obligation to update forward-looking statements. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.